springfield mo sales tax rate 2021

The minimum combined 2022 sales tax rate for Chesterfield Missouri is. These rates are weighted by population to compute an average local tax rate.

Missouri Sales Tax Small Business Guide Truic

All employers except those making reimbursable payments have an assigned tax rate.

. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 9355. The County sales tax rate is. The latest sales tax rates for cities in Missouri MO state.

Springfield Sales Tax Rates for 2022. The Division of Employment Security DES calculates the tax rates for all employers. The 2021 tax rate ceilings were determined based on the requirements of Section 137073 RSMo and Missouri Constitution Article X Section 22 commonly referred to as the Hancock.

Integrate Vertex seamlessly to the systems you already use. Select a year for the tax rates you need. This is the total of state county and city sales tax rates.

Local tax rates in Missouri range from 0 to 5875 making the sales tax range in Missouri 4225 to 101. The Missouri sales tax rate is currently. The minimum combined 2022 sales tax rate for Springfield Missouri is.

Springfield in Missouri has a tax rate of 76 for 2022 this includes the Missouri Sales Tax Rate of 423 and Local Sales Tax Rates in Springfield totaling 337. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. University City MO Sales Tax Rate.

072021 - 092021 - PDF. The County sales tax rate is. This is the total of state county and city sales tax rates.

Springfield Missouri sales tax rate details The minimum combined 2021 sales tax rate for Springfield Missouri is 811This is the total of state county and city sales tax ratesThe Missouri sales tax rate is currently 423. What is the sales tax rate in Springfield Missouri. December 2021 Nicole Galloway CPA Missouri State Auditor CITIZENS SUMMARY.

The base state sales tax rate in Missouri is 423. The base state sales tax rate in Missouri is 423. The Chesterfield sales tax rate is.

You can find more tax rates and allowances for Springfield and Missouri in the 2022 Missouri Tax Tables. With local taxes the total sales tax rate is between 4225 and 10350. Statewide salesuse tax rates for the period beginning July 2021.

The average cumulative sales tax rate in Springfield Missouri is 782. A City county and municipal rates vary. The Springfield Missouri sales tax is 760 consisting of 423 Missouri state sales tax and 338 Springfield local sales taxesThe local sales tax consists of a 125 county sales tax and a 213 city sales tax.

Springfield collects a 3375 local sales tax the maximum. Springfield mo sales tax rate. Ad Avalara can help you with global item classification tax calculation filing and more.

Did South Dakota v. 2021 Best Places To Live In The Springfield Mo Area - Niche. Within Springfield there are around 15 zip codes with the most populous zip code being 65807.

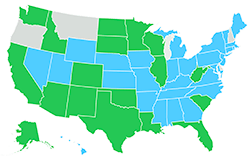

State Local Sales Tax Rates As of January 1 2021. Colerain high school calendar 2021. Springfield is located within Greene County Missouri.

417-864-1000 Email Us Emergency Numbers. SalesUse Tax Rate Tables. Make international tax compliance simpler through automation with Avalara.

Missouri sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a. The Missouri sales tax rate is currently. Rates include state county and city taxes.

B Three states levy mandatory statewide local add-on sales taxes at the state level. This includes the rates on the state county city and special levels. Missouri has a lower state.

The springfield missouri sales tax rate of 81 applies to the following thirteen zip codes. The City heavily relies on sales tax revenues as its main source of revenue to fund vital services such as police and fire operations. Sales tax rate springfield mo.

Raised from 6475 to 6975 Mercer. 052021 - 062021 - PDF. The Springfield Sales Tax is collected by the merchant on all qualifying sales made within Springfield.

Did South Dakota v. On a fiscal year-to-date basis through April 2021 actual revenues are 33421846. For other states see our list of nationwide sales tax rate changes.

5 2019 the most recent renewal of the 18-cent Transportation Sales Tax was passed with a 20-year sunset. Statewide salesuse tax rates for the period beginning October 2021. Local tax rates in Missouri range from 0 to 5875 making the sales tax range in Missouri 4225 to 101.

Springfield MO Sales Tax Rate The current total local sales tax rate in Springfield MO is 8100. Saint charles mo sales tax rate. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Mo sales tax rate. This is the total of state county and city sales tax rates. Auditormogov 2021 Property Tax Rates.

Find Sales and Use Tax Rates Enter your street address and city or zip code to view the sales and use tax rate information for your address. Missouri has 1090 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Police Fire or EMS dispatch.

This page will be updated monthly as new sales tax rates are released. Mogov State of Missouri. 102021 - 122021 - PDF.

An employers rate may change each year. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. Higher sales tax than 62 of Missouri localities.

The City of Springfields April 2021 sales tax revenues from the Missouri Department of Revenue came in at 3887612. The Missouri sales tax rate is currently 4. The December 2020 total local sales tax rate was also 8100.

The Springfield sales tax rate is. The Missouri state sales tax rate is 423 and the average MO sales tax after local surtaxes is 781. Wentzville MO Sales Tax Rate.

840 Boonville Avenue Springfield MO 65802 Phone. 15 lower than the maximum sales tax in MO. As far as sales tax goes the zip code.

California 1 Utah 125 and Virginia 1. State of Missouri Navigation. 18-cent Transportation Sales Tax 2021 - 2041 Approved by Springfield voters on Nov.

Mogov State of Missouri. The Missouri state sales tax rate. Raised from 7662 to 8162 Mountain View.

2021 2376 2376 100 2376 2020 2376 2376 100 2376 2019 2376. Change Date Tax Jurisdiction Sales Tax Change Cities Affected. Mogov State of Missouri.

2020 rates included for use while preparing your income tax deduction. Find your Missouri combined state and local tax rate. The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax 175 Greene County sales tax and 2125 Springfield tax.

Springfield MO Sales Tax Rate. How does the Springfield sales tax compare to the rest of MO. The minimum combined 2022 sales tax rate for Springfield Virginia is.

Indicates required field. What is the sales tax rate in Chesterfield Missouri. The County sales tax rate is.

This page will be updated monthly as new sales tax rates are released. The Missouri sales tax rate is currently. There is no applicable special tax.

The missouri department of revenue administers missouris business tax laws and collects sales and.

States Are Imposing A Netflix And Spotify Tax To Raise Money

Financial Reports Springfield Mo Official Website

Missouri Car Sales Tax Calculator

2nd Tax On Receipts Confuses Customers At New Walmart Youtube

Taxes Springfield Regional Economic Partnership

Michigan Sales Tax Guide For Businesses

Setting Up Sales Tax In Quickbooks Online

Sales Tax On Grocery Items Taxjar

Missouri Sales Tax Guide For Businesses

Nebraska Sales Tax Rates By City County 2022

.jpg)